Tax season can be stressful and cause much anxiety for many taxpayers, especially those anticipating a tax refund and anxiously waiting for the funds to arrive.

Figuring out your refund status can be confusing and frustrating at times. One of the most common questions is, “Where’s my refund?”

Fortunately, the federal government and individual states offer online tools and apps to help taxpayers track the status of their tax refunds.

In this comprehensive guide, we will explore the tools and resources available to assist you in answering common questions such as “Where’s my state refund?” ” Where’s my amended refund?” and “Where’s my federal refund?”

What is State Income Tax?

State income tax is a tax imposed by individual states on the income earned by residents and, in some cases, non-residents within their jurisdiction. It operates independently of federal income tax and is typically assessed based on the taxpayer’s total income.

The rates and rules for state income tax vary widely among states. Some states have a progressive income tax system, where tax rates increase as income levels rise, while others have a flat tax rate, where all taxpayers pay the same percentage of their income in taxes.

Additionally, states may offer various deductions, credits, and exemptions to reduce the overall tax burden for certain taxpayers.

States with No Income Tax

A few states do not impose a state income tax on residents but rather generate state income from other sources. These include:

- Alaska: The state primarily relies on revenue from oil and gas production.

- Florida: The state’s revenue comes from other sources, such as sales taxes and tourism.

- Nevada: The state generates revenue from sales taxes, tourism, and other sources.

- South Dakota: The state’s revenue is derived from sales taxes, property taxes, and other sources.

- Tennessee: The state’s revenue primarily comes from sales taxes, property taxes, and other sources.

- Texas: The state’s revenue comes from sales taxes, property taxes, and other sources.

- Wyoming: The state’s revenue primarily comes from mineral extraction taxes, sales taxes, and other sources.

Other State Tax Exceptions

- Washington: There is no general state income tax; however, some high-earners are taxed on capital gains.

- New Hampshire: There is no general state income tax; however, they tax interest and dividends income.

State Income Tax Rates

Provided is a breakdown of the various tax rates by state. Please note that some states have complex tax structures with multiple brackets or special rules, and the information provided here is a general overview.

We strive to provide the most up-to-date information possible. However, state rates may change yearly, so you should confirm the rates with your tax professional.

| State | Lowest Tax Rate (%) | Highest Tax Rate (%) | Type of Income Tax |

| Alabama | 2.00% | 5.00% | Graduated rate |

| Alaska | 0.00% | 0.00% | No Income Tax |

| Arizona | 2.50% | 2.50% | Flat rate |

| Arkansas | 2.00% | 4.90% | Graduated rate |

| California | 1.00% | 13.30% | Graduated rate |

| Colorado | 4.40% | 4.40% | Flat rate |

| Connecticut | 3.00% | 6.99% | Graduated rate |

| Delaware | 2.20% | 6.60% | Graduated rate |

| District of Columbia | 4.00% | 10.70% | Graduated rate |

| Florida | 0.00% | 0.00% | No Income Tax |

| Georgia | 1.00% | 5.75% | Graduated rate |

| Hawaii | 1.40% | 11.00% | Graduated rate |

| Idaho | 5.80% | 5.80% | Flat rate |

| Illinois | 4.95% | 4.95% | Flat rate |

| Indiana | 3.15% | 3.15% | Flat rate |

| Iowa | 4.40% | 6.00% | Graduated rate |

| Kansas | 3.10% | 5.70% | Graduated rate |

| Kentucky | 4.50% | 4.50% | Flat rate |

| Louisiana | 1.85% | 4.25% | Graduated rate |

| Maine | 5.80% | 7.15% | Graduated rate |

| Maryland | 2.00% | 5.75% | Graduated rate |

| Massachusetts | 5.00% | 9.00% | Graduated rate |

| Michigan | 4.25% | 4.25% | Flat rate |

| Minnesota | 5.35% | 9.85% | Graduated rate |

| Mississippi | 5.00% | 5.00% | Flat rate |

| Missouri | 2.00% | 4.95% | Graduated rate |

| Montana | 1.00% | 6.75% | Graduated rate |

| Nebraska | 2.46% | 6.64% | Graduated rate |

| Nevada | 0.00% | 0.00% | No Income Tax |

| New Hampshire | 0.00% | 0.00% | No income tax (exempt on interest and dividends) |

| New Jersey | 1.40% | 0.70% | Graduated rate |

| New Mexico | 1.70% | 5.90% | Graduated rate |

| New York | 4.00% | 10.90% | Graduated rate |

| North Carolina | 4.75% | 4.75% | Flat rate |

| North Dakota | 1.10% | 2.90% | Graduated rate |

| Ohio | 2.76% | 3.99% | Graduated rate |

| Oklahoma | 0.25% | 4.75% | Graduated rate |

| Oregon | 4.75% | 9.90% | Graduated rate |

| Pennsylvania | 3.07% | 3.07% | Flat rate |

| Rhode Island | 3.75% | 5.99% | Graduated rate |

| South Carolina | 0.00% | 6.50% | Graduated rate |

| South Dakota | 0.00% | 0.00% | No Income Tax |

| Tennessee | 0.00% | 0.00% | No Income Tax |

| Texas | 0.00% | 0.00% | No Income Tax |

| Utah | 4.65% | 4.65% | Flat rate |

| Vermont | 3.35% | 8.75% | Graduated rate |

| Virginia | 2.00% | 5.75% | Graduated rate |

| Washington | 0.00% | 0.00% | No Income Tax (except cap gains for high-earners) |

| West Virginia | 3.00% | 6.50% | Graduated rate |

| Wisconsin | 3.54% | 7.65% | Graduated rate |

| Wyoming | 0.00% | 0.00% | No Income Tax |

KEY TAKEAWAYS

- In addition to Federal income taxes, you can expect to pay State income taxes in most states.

- State income tax rates vary from 0% to over 13%. Several states do not have an income tax.

- If you expect a Federal or State refund, you can check the status online or through the IRS2GO mobile app.

Where’s My State Refund?

In addition to a Federal refund, you may be eagerly awaiting your state tax refund. Fortunately, most states offer a tool to track the status of state tax refunds. These tools are sometimes labeled as “Where’s My State Refund” or similar variations.

In today’s ever-changing work environment, more people are working remotely. This means you may need to file taxes in multiple states, not just your state of residency, and you could be owed a refund from various states.

You can learn more about how to check the status of a specific state refund by selecting your state from the list below:

It’s worth noting that the processing times for state refunds may vary, and you should check with your specific state revenue agency for more accurate and up-to-date information.

Also, like other federal tools, you must typically input your Social Security number, filing status, and the expected refund amount.

Must read articles related to Taxes

- What are the benefits of married filing separate?

- Are you required to file taxes?

- How long should you keep tax returns?

- Figure out where’s my amended refund.

- The ins and outs of OASDI tax.

Where’s My Federal Refund?

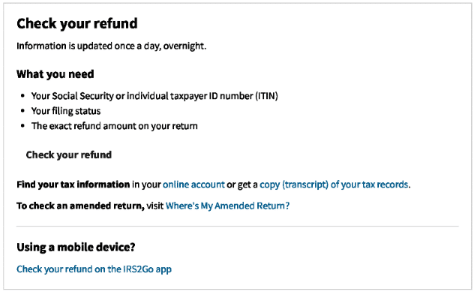

The IRS provides a user-friendly online tool called “Where’s My Refund,” designed to help taxpayers stay informed about the status of their federal tax refunds. To access this tool, taxpayers can visit the official IRS website and navigate to the Where’s My Refund page.

The Where’s My Tax Refund tool can be used within 24 hours after the IRS receives your e-filed return. For those who file a paper return, the tool becomes available about four weeks after mailing the return.

To check your tax refund status, you must provide your Social Security number or Individual Taxpayer Identification Number, your filing status, and the exact amount of the refund claimed on your tax return.

The tool offers three stages of the refund process:

- Return Received

- Refund Approved

- Refund Sent

Each stage provides a specific status update, offering transparency and peace of mind to taxpayers eagerly awaiting their refunds.

IRS2GO Mobile App

Alternatively, the IRS has created a Mobile App to check the status of your refund that functions similarly to the online Where’s My Refund tool. The IRS2Go is the official IRS mobile app. It can be used to check your refund status, but you can also make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more.

You can download a copy of the IRS2Go Mobile app from Google Play, AppStore, and Amazon.

Where Is My Amended Refund?

If you’ve amended your tax return and determined that you are now owed a refund, you may wonder, “Where’s my amended refund?”

Luckily for you, the IRS has a tool to check the status of your amended refund. We’ve provided a comprehensive review of the process for reviewing the status of your amended refund.

TIP

To optimize the tax refund process, you should file your return electronically, double-check that all your information is correct, and understand your state’s specific guidelines.

Optimizing Your Tax Refund Experience

Now that we’ve explored the tools available for tracking Federal and state tax refunds let’s explore some tips for optimizing your tax refund experience.

File Electronically

Filing your tax return electronically (e-filing) is faster and more secure and allows you to use the Where’s My Refund tool sooner. E-filed returns can be tracked within 24 hours of filing, providing a quicker insight into the refund process.

Double-Check Your Information

Accuracy is critical when using refund tracking tools. Ensure that the information you provide, such as your Social Security number, filing status, and refund amount, matches the details on your tax return. Any discrepancies can lead to delays in processing.

Understand Amended Return Timelines

If you’ve submitted an amended return, be patient. The processing time for amended returns is generally longer than regular returns. It may take up to 16 weeks for the IRS to process an amended return, and tracking its progress through Where’s My Amended Refund will keep you informed.

Check State-Specific Guidelines

Since each state may have its own processing timelines and procedures, you must familiarize yourself with your state’s specific guidelines. Check the official website of your state’s revenue agency for accurate and timely information.

The Bottom Line

As tax season approaches, tracking the status of your Federal and state tax refunds provides a sense of control and assurance. The IRS Where’s My Refund and Where’s My Amended Refund tools offer transparency into the refund process, allowing taxpayers to stay informed at every stage.

For state tax refunds, the convenience of tools like Where’s My State Refund makes the overall experience smoother. By optimizing your tax refund process through electronic filing and accurate information submission, you can confidently navigate the tax season.

Remember, staying informed is the key to a stress-free tax season. Utilize these online tools, follow the provided tips, and soon enough, you’ll be well on your way to receiving your hard-earned tax refund.

Frequently Asked Questions

The timing of your refund depends on several factors. It usually takes up to 21 days to process an e-filed return, four weeks or more for amended returns and returns sent by mail, and potentially longer if your return needs corrections or extra review.

Each state handles the processing of tax refunds differently, so there is no exact timeline for when your particular state will process your return and issue refunds.

The best course of action is to visit your state webpage and follow the steps to determine the status of your refund.

The easiest way to check the status of your federal refund is to use the IRS Where’s My Refund tool. If you filed your taxes electronically, you should be able to view the status of your tax refund and return within 24 hours of filing.

You can quickly check the status of your amended return using the IRS Where’s My Amended Refund tool. However, it is important to note that it can take up to three weeks after filing your amended return for status to appear in the system.

No, certain states do not tax any of your Social Security income, while others may charge taxes on all or a portion of your Social Security income.

You can find a Social Security Administration office near you by using our SSA office locator and searching for your closest location.