Tax season can be a stressful time and cause much anxiety for many taxpayers, especially those anticipating a tax refund and anxiously waiting for the funds to arrive. It can be quite confusing and frustrating at times trying to figure out the status of your refund. One of the most common questions is, “Where’s my refund?”

Fortunately, both the federal government and individual states offer online tools and apps to help taxpayers track the status of their tax refunds.

In this comprehensive guide, we will explore the tools and resources available to assist you in answering common questions such as “Where is my amended refund?” “Where’s my federal refund?” and “Where’s my state refund?”

What is an Amended Tax Return?

An amended tax return is a tax return filed to correct errors or change a previously filed tax return. You may need to file an amended return if you realize you’ve made mistakes on the original return.

Here are some common reasons why a taxpayer might need to file an amended tax return:

- Correction of Errors

- Reporting Additional Income

- Claiming Missed Deductions or Credits

- Change in Filing Status

- Changes in Dependents

It’s important to note that amended returns must be filed using Form 1040x and generally must be filed within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later.

Depending on the changes made, filing an amended return may result in additional taxes owed or an amended tax refund.

Where Is My Amended Refund?

If you’ve amended your tax return and determined that you are now owed a refund, you may be wondering, “Where’s my amended refund?”

Luckily for you, the IRS has a tool to check the status of your amended refund. For this purpose, the IRS created a unique tool called Where’s My Amended Refund.

This tool allows you, the taxpayer, to track the status of your amended return, providing information on whether it is in receipt, processing, or completion stages.

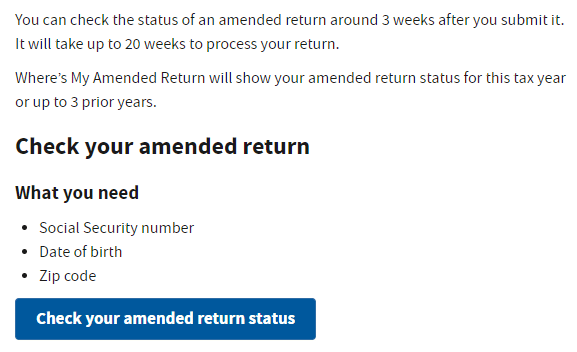

You’ll know you are on the right page if you see an image like this:

To use the Where’s My Amended Tax Refund tool, enter your Social Security number, date of birth, and the ZIP code from your original return.

- It is important to note that you may need to wait up to three weeks after filing your amended return before a status will appear in the system.

Alternatively, you can call the toll-free telephone number 866-464-2050 to check the status of your amended return/refund and confirmation of receipt. Keep in mind that you may experience long wait times when calling the IRS.

It’s recommended that you utilize online tools. This is usually the fastest way to verify the status of your refund and will provide the most up-to-date information.

KEY TAKEAWAYS

- If you realize you’ve made mistakes on your original tax return, you must file an amended return to correct the errors.

- The IRS has a tool designed to check the status of your amended return and, if applicable, your refund.

- The IRS Where’s My Amended Refund tool does not work with all types of amended returns.

Can I use the IRS Where’s My Amended Refund tool to check all types of amended returns?

No, the tool only works for certain types of amended returns. It will not work for the following types of returns:

- Business Returns

- Returns with a Foreign Address

- Carryback Applications and Claims

- Injured Spouse Claims

- Form 1040 marked as an amended or corrected return (instead of a 1040x)

- Returns Processed by Special Units such as Examination or Bankruptcy

If you have any of the following types of returns, you must contact the IRS directly. The IRS phone number will vary depending on your specific situation and type of return.

Must read articles related to Taxes

- What are the benefits of married filing separate?

- Are you required to file taxes?

- How long should you keep tax returns?

- Figure out where’s my amended refund.

- The ins and outs of OASDI tax.

Where’s My Federal Refund?

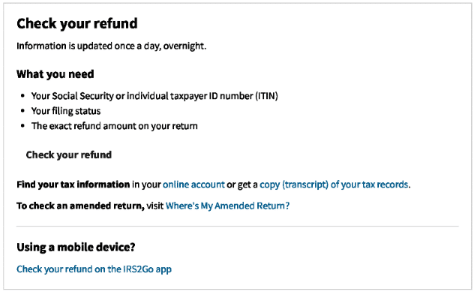

The IRS provides a user-friendly online tool called “Where’s My Refund,” designed to help taxpayers stay informed about the status of their federal tax refunds. To access this tool, taxpayers can visit the official IRS website and navigate to the Where’s My Refund page.

The Where’s My Tax Refund tool can be used within 24 hours after the IRS receives your e-filed return. For those who file a paper return, the tool becomes available about four weeks after mailing the return.

To check your tax refund status, you must provide your Social Security number or Individual Taxpayer Identification Number, your filing status, and the exact amount of the refund claimed on your tax return.

The tool offers three stages of the refund process:

- Return Received

- Refund Approved

- Refund Sent

Each stage provides a specific status update, offering transparency and peace of mind to taxpayers eagerly awaiting their refunds.

IRS2GO Mobile App

Alternatively, the IRS has created a Mobile App to check the status of your refund that functions similarly to the online Where’s My Refund tool. The IRS2Go is the official IRS mobile app. It can be used to check your refund status, but you can also make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more.

You can download a copy of the IRS2Go Mobile app from Google Play, AppStore, and Amazon.

Where’s My State Refund?

In addition to a Federal refund, you may be eagerly awaiting your state tax refund. Fortunately, most states offer their own tools to track the status of state tax refunds. These tools are sometimes labeled as “Where’s My State Refund” or similar variations.

To access the respective tool, visit the official website of your state’s revenue agency. Like the Federal tool, you must typically input your Social Security number, filing status, and the expected refund amount.

It’s worth noting that the processing times for state refunds may vary, and you should check with your specific state revenue agency for more accurate and up-to-date information.

TIP

To optimize the tax refund process, you should file your return electronically, double-check that all your information is correct, and understand your state’s specific guidelines.

Optimizing Your Tax Refund Experience

Now that we’ve explored the tools available for tracking Federal and state tax refunds let’s explore some tips for optimizing your tax refund experience.

File Electronically

Filing your tax return electronically (e-filing) is faster and more secure and allows you to use the Where’s My Refund tool sooner. E-filed returns can be tracked within 24 hours of filing, providing a quicker insight into the refund process.

Double-Check Your Information

Accuracy is critical when using refund tracking tools. Ensure that the information you provide, such as your Social Security number, filing status, and refund amount, matches the details on your tax return. Any discrepancies can lead to delays in processing.

Understand Amended Return Timelines

If you’ve submitted an amended return, be patient. The processing time for amended returns is generally longer than regular returns. It may take up to 16 weeks for the IRS to process an amended return, and tracking its progress through Where’s My Amended Refund will keep you informed.

Check State-Specific Guidelines

Since each state may have its own processing timelines and procedures, you must familiarize yourself with your state’s specific guidelines. Check the official website of your state’s revenue agency for accurate and timely information.

The Bottom Line

As tax season approaches, tracking the status of your Federal and state tax refunds provides a sense of control and assurance. The IRS Where’s My Refund and Where’s My Amended Refund tools offer transparency into the refund process, allowing taxpayers to stay informed at every stage.

For state tax refunds, the convenience of tools like Where’s My State Refund makes the overall experience smoother. By optimizing your tax refund process through electronic filing and accurate information submission, you can confidently navigate the tax season.

Remember, staying informed is the key to a stress-free tax season. Utilize these online tools, follow the provided tips, and soon enough, you’ll be well on your way to receiving your hard-earned tax refund.

Frequently Asked Questions

The timing of your refund depends on several factors. To process a refund, it usually takes, up to 21 days for an e-filed return, 4 weeks or more for amended returns and returns sent by mail, and potentially longer if your return needs corrections or extra review.

The easiest way to check the status of your federal refund is to use the IRS Where’s My Refund tool. If you filed your taxes electronically, you should be able to view the status of your tax refund and return within 24 hours of filing.

The current processing time for amended returns is over 20 weeks for both paper and e-filed returns.

You can check out the current processing status dashboard for more up-to-date timeframes.

Additionally, calling the IRS will not speed up return processing. Phone and walk-in representatives will only research the status of your amended return 20 weeks or more after you filed it or if you received a notice to contact the IRS.

Yes, beginning in processing year 2023, direct deposit can be requested for e-filed returns for tax year 2021 and later. The bank account information should be entered on the electronically filed Form 1040x.

You can find a Social Security Administration office near you by using our SSA office locator and searching for your closest location.